Too Big to Fail versus Too Small to Fail

Buy Locally, Hire Locally, Invest Locally

I first heard the term “Too Small to Fail” as the title of a CD by satirists Mikhail Horowitz and Gilles Malkine I then did a little more research and found a book by Louis Hernandez, Too Small to Fail, about community banking.

Too Small to Fail, about community banking.

I have been thinking and writing about how local food, local energy, local businesses, community/public banking, local currencies, and resilient communities are strategically positioned to be “too small to fail” as opposed to bloated Wall Street financial Institutions, “sunset industries,” and corporate farming that have been, and probably will continue to be bailed out because they are “Too Big to Fail.” The term “too big to fail” may have been first used by Congressman Stewart McKinney in a Congressional hearing, discussing the FDIC’s intervention with Continental Illinois in 1984.

“Nearly a century ago, Justice Louis Brandeis railed against what he called the “curse of bigness.” He warned that banks, railroads and steel companies had grown so huge that they were lording it over the nation’s economic and political life. “Size, we are told, is not a crime,” Brandeis wrote. “But size may, at least, become noxious by reason of the means through which it is attained or the uses to which it is put.”

Federal Reserve Chair Ben Bernanke also defined the term in 2010:

Federal Reserve Chair Ben Bernanke also defined the term in 2010:

“A too-big-to-fail firm is one whose size, complexity, interconnectedness, and critical functions are such that, should the firm go unexpectedly into liquidation, the rest of the financial system and the economy would face severe adverse consequences.” He continued that: “Governments provide support to too-big-to-fail firms in a crisis not out of favoritism or particular concern for the management, owners, or creditors of the firm, but because they recognize that the consequences for the broader economy of allowing a disorderly failure greatly outweigh the costs of avoiding the failure in some way. Common means of avoiding failure include facilitating a merger, providing credit, or injecting government capital, all of which protect at least some creditors who otherwise would have suffered losses…If the crisis has a single lesson, it is that the too-big-to-fail problem must be solved.”

In Andrew Ross Sorkin’s book, Too Big to Fail, the Inside Story of How Wall Street and Washington Fought to Save the Financial System and Themselves, he wrote that in a “Too Big to Fail” scenario, assertions have been made that certain financial institutions are so large and so interconnected that their failure would be disastrous to the economy, and they therefore must be supported by government when they face difficulty. The book  was adapted in 2011 for the television movie Too Big to Fail. The financial meltdown and

was adapted in 2011 for the television movie Too Big to Fail. The financial meltdown and

the global economic crisis resulting from the sub-prime mortgage debacle began to change the public’s perception of previously trusted financial institutions.

Some economists such as Paul Krugman have asserted that economies of scale in banks and in other businesses are worth preserving, so long as they are well regulated. Other economists, financial experts, bankers (like Former Citigroup Chairman & CEO Sanford I. Weill), finance industry groups, and banks themselves have called for breaking up large banks into smaller institutions and assert that a companies that benefit from these “too big to fail” policies will deliberately take risky, unsound positions, without being responsible for the losses.

Louis Hernandez, Jr., said in his book, Too Small to Fail:

“….. using historical examples, points out that the rate of change impacting the financial services industry is accelerating. The industry has been slow to respond to change, and the focus on the recent crisis has uncovered fundamental problems that financial institutions have been avoiding…”

Too Small to Fail:

Resilient communities are at the core of a Too Small to Fail future. If we don’t plan for more robust communities, and implement solutions for undeniable problems, a catastrophic crash seems inevitable. However crisis can equal opportunity as we saw during the Great Depression and during World War II. But unless sensible plans to manage disaster are formulated and put forward now, the opportunity afforded by crisis could be hijacked by a more organized well-financed minority with an authoritarian agenda.

“Our economic system has failed in every dimension: financial, environmental, and social. Moreover the current financial collapse provides an incontestable demonstration that it is unable to self-correct.… The need is not to repair Wall Street but to replace it with institutions devoted to serving the financial needs of ordinary people in ways that are fair, honest, and consistent with the reality of our human dependence on Earth’s biosphere.” David Korten,Agenda for a New Economy

The Too Small to Fail or the New Economy movement is a response to the systemic failure of the “old” economy. It is an economy in which real wealth – something that has intrinsic value – forms the basis for enterprises that provide for their employees, their customers, the community in which they are located, and make a profit for the owners.

Wall Street (Too Big to Fail) and Main Street (To Small to Fail) are names given to two  economies with significantly different priorities and values that are often in competition. Wall Street is in the business of making money to make money. Any involvement in the production of real goods and services is an incidental byproduct. Once a company, even one that started by making a useful product, begins to sell shares through exchanges or to private equity investors it becomes an agent of Wall Street. As a former executive of Odwalla told David Korten, “So long as we were privately owned by the founders, we were in the business of producing and marketing healthful fruit juice products. Once we went public, everything changed. From that event forward, we were in the business of making money.”

economies with significantly different priorities and values that are often in competition. Wall Street is in the business of making money to make money. Any involvement in the production of real goods and services is an incidental byproduct. Once a company, even one that started by making a useful product, begins to sell shares through exchanges or to private equity investors it becomes an agent of Wall Street. As a former executive of Odwalla told David Korten, “So long as we were privately owned by the founders, we were in the business of producing and marketing healthful fruit juice products. Once we went public, everything changed. From that event forward, we were in the business of making money.”

The need is not to repair Wall Street but to replace it with institutions devoted to serving the financial needs of ordinary people in ways that are fair, honest and consistent with the reality of our human dependence on Earth’s biosphere. David Korten Page 8, Agenda for a New Economy

My grandfather started a lumber company with a friend who owned a pushcart. They scavenged construction sites, pulled nails out of and squared up any lumber they could find, and sold it for what it was – a recycled product. Later they built their company into a large wholesale/retail lumberyard, and eventually became a self-serve regional hardware and lumber company. But what my grandfather and my uncles, who eventually took over the business, never forgot was that they had an obligation to their employees, many of whom worked at the company for their entire careers. They sold a good product, treated their customers with respect, supported their community, and made a living for their families. After my uncles retired, their partner sold the company to a Fortune 500 company and within a few years it no longer existed.

I tell this story because this Main Street business was locally owned, locally rooted, and  privately held. It was innovative, successful, and sold tools, materials, and services to people who became repeat customers because of the quality and customer service they received. As soon as their company became the property of Wall Street, all those values were lost and destroyed, until then it had been too small to fail.

privately held. It was innovative, successful, and sold tools, materials, and services to people who became repeat customers because of the quality and customer service they received. As soon as their company became the property of Wall Street, all those values were lost and destroyed, until then it had been too small to fail.

“If your niche is small enough, the customer need strong enough, your marketing targeted enough, your product good enough, your customers happy enough, they are going to buy, recession or not.”

Growing evidence suggests that every dollar spent at a To Small to Fail locally owned business generates two to four times more economic benefit – measured in income, wealth, jobs, and tax revenue – than a dollar spent at a globally owned business. That is because locally owned businesses spend much more of their money locally and thereby pump up the economic multiplier.

“One reason for growing public interest in local investment is the spread of “buy local” campaigns, a movement that is more than just local hucksterism. Consider the title of an article in a recent issue of Time: “Buying Local: How It Boosts the Economy.” Cutting-edge economic developers (except at the national level) increasingly recognize the importance of strengthening locally owned, small businesses.” Michael Shuman, The Small Mart Revolution

A well-run, buy local campaign that engages Too Small to Fail businesses and citizens,  can be a powerful tool for sustaining independent businesses. Buy independent / buy local campaigns have exploded in recent years, bolstered by four annual surveys by the Institute for Local Self-Reliance. The surveys show large benefits to independent businesses and communities from sustained campaigns by independent business alliances and similar organizations. Two groups, the American Independent Business Alliance, AMIBA and the Business Alliance for Local Living Economies, BALLE, are advocates for The Main Street

can be a powerful tool for sustaining independent businesses. Buy independent / buy local campaigns have exploded in recent years, bolstered by four annual surveys by the Institute for Local Self-Reliance. The surveys show large benefits to independent businesses and communities from sustained campaigns by independent business alliances and similar organizations. Two groups, the American Independent Business Alliance, AMIBA and the Business Alliance for Local Living Economies, BALLE, are advocates for The Main Street  economy and buy local/hire local campaigns.

economy and buy local/hire local campaigns.

Small towns like Stonington, ME,and large cities like Seattle, WA, have effective buy local and hire local campaigns. A New York City organization, Grow NYC, has a buy local food campaign.

The Outlook for our Region:

Creating this kind of Too Small to Fail economy with “Main Street values” for the NYC Bioregion is difficult, in part because it is almost impossible for individuals to put money into worthy small businesses in need of capital. Our financial markets have evolved to serve big business even though small enterprises create three out of every four jobs and generate half of GDP. If you add in other “place based” nonprofits, co-ops, and the public sector, it is nearly 58 percent of all economic activity.

Under our present system, no local businesses receive any of our pension savings, or  investments in mutual funds, or investment from venture capital firms, or hedge funds. The result is that we who invest do so in Fortune 500 companies we distrust, and under-invest in the local businesses we know are essential for local vitality. We need new mechanisms to enable investment in local, place-based, Too Small to Fail Main Street Businesses.

investments in mutual funds, or investment from venture capital firms, or hedge funds. The result is that we who invest do so in Fortune 500 companies we distrust, and under-invest in the local businesses we know are essential for local vitality. We need new mechanisms to enable investment in local, place-based, Too Small to Fail Main Street Businesses.

Main Street investing is how the local economy once functioned. It was in the interest of well-off farmers, merchants, and small town banks to loan money to, and invest in, businesses that would hire local people, and make something that had value and created  real wealth. Perhaps, along with a “buy local/hire local campaigns, “Locavesting,” – a resurgence of local currencies, and new public and community banks, and credit unions will reinvigorate our region’s “main street” Too Small to Fail economy

real wealth. Perhaps, along with a “buy local/hire local campaigns, “Locavesting,” – a resurgence of local currencies, and new public and community banks, and credit unions will reinvigorate our region’s “main street” Too Small to Fail economy

“In a world of sprawling multinational conglomerates and complex securities disconnected from place and reality, there is something very simple and transparent about investing in a local company that you can see and touch and understand. As investing guru Peter Lynch has counseled, it makes sense to invest in what you know.” Amy Cortese, Locavesting Preface pg. xi

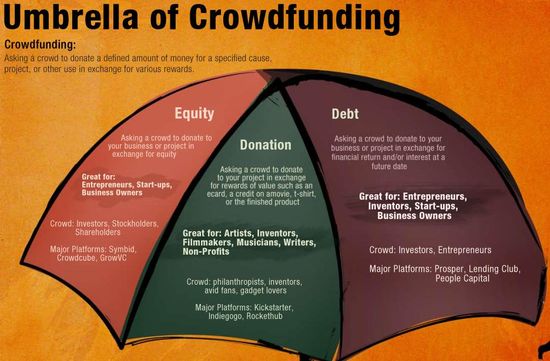

The New York Metropolitan bioregion needs new investment opportunities like crowd funding and “locavesting.” We need more cooperatives and employee owned businesses with short supply chains, farm to table restaurants, low tech manufacturing jobs, (urban, rural, and suburban) farming, public and community banks, complementary non-profits, and local currencies to boost investment in local, place-based Too Small to Fail Businesses.

One bit of good news for the Bioregional Too Small to Fail economy, is that President Obama signed the JOBS Act in April 2012, opening up a new source of funding for small  companies and start ups. Much of the attention so far has been on this component of the

companies and start ups. Much of the attention so far has been on this component of the

bill because it would allow financing via crowd funding. Participants can raise as much as $1 million a year without having to do a public offering – a step requiring state-by-state registrations that can cost thousands of dollars. The belief – and hope – is that this type of funding will open up more opportunities for capital to flow into start ups. That, in turn, will help grow new companies and create new jobs.

When looking at the opportunities for investment in our Bioregion, one must also look at local capital available for building this infrastructure. Amy Cortese, author of Locavesting, posits a compelling question: If Americans have about $30 trillion invested, “imagine if half of that, $15 trillion, was invested in local communities rather than multinational conglomerates that are outsourcing jobs and not investing domestically. I think we’d be living in a far different world. That said, it is a little idealistic to think we’ll ever get to 50% any time soon. But even think about 10% or 5% or 1%. One percent of $26 trillion is $260 billion going to the Main Street economy and that’s a lot.….. (T)here is a very compelling case to be made for local investments as an asset class in a diversified portfolio.”

We urgently need to replace the current Too Big to Fail system with one that reasserts the right to a safe, healthy, productive environment for all; where “environment” is considered in its totality, inclusive of ecological, physical (natural and built); social, political, aesthetic, economic environments; and environmental justice.

In the new Too Small to Fail system, the rights of individuals and groups must be equally preserved and respected in a way that provides for self-actualization and personal and community empowerment. A community in which poverty and inequity are considered acceptable will always be prone to environmental and economic crises.

So we have choices to make as a community and a bio-region. Do we hope for “divine or alien” intervention, or do we start making our communities more resilient, invest in local  businesses, and start local public banks and community based currencies?

businesses, and start local public banks and community based currencies?

In a world of sprawling multinational conglomerates and complex securities disconnected from place and reality, there is something very simple and transparent about owning or investing in a Too Small to Fail business, that you can see and touch and understand.